March 2023 - Hold onto your undies, we’re coming in to land

by Stephen Bennie 2023-03-08

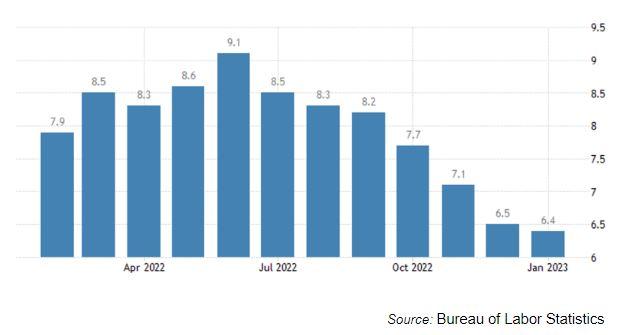

Last year was a torrid time for most asset classes and most investors, but at least there was no mystery over what created the chaos – rampant inflation. Higher inflation than developed economies have seen in decades was a problem and was compounded by the super low cash rates that still prevailed as 2022 began. In retrospect it is fairly easy to see why share markets hit peak panic in June last year - the US Consumer Price Index (CPI) topped 9%. While share markets didn’t stage any miracle comeback in the second half of 2022, they at least didn’t get a whole lot worse. That was likely in a large part due to inflation readings starting to cool.

Chart showing the recent colling in US CPI

The chart above shows that the months since June last year have seen CPI readings that were consistently lower than the previous month. Meanwhile, over that period central banks have been hiking cash rates, the US Federal Reserve finishing this period with its cash rate at 4.75-5.00%. This is still not quite where they probably need to get to (consensus currently has that as 5.5%) but a heap closer than they sat a year ago. This is a far more palatable situation which has seen share markets calming a fraction in recent months.

The next phase of this share market cycle will play out as we discover what impact that these higher cash rates will have on economic growth. There can be little doubt that the significant tightening of monetary conditions hampers economic expansion, likely to go to the point where it leads to economic contraction, the dreaded R word, recession.

However, not all recessions are created equal. Some are short and modest contractions, some are longer and deeper slowdowns. The former is often referred to as a soft landing while the latter is understandably known as a hard landing. Get ready for a sweeping generalisation; soft landing - good, hard landing - bad.

A deep recession will almost certainly see share markets make new lows, with further bouts of nasty volatility. Very few people want to see a deep recession, central banks don’t, governments don’t, workers don’t, consumers don’t, retirees don’t, and corporates certainly don’t. However, it must be acknowledged they do happen nonetheless. But the scenario that all these participants of an economy would rather see is a short, shallow recession, a soft landing.

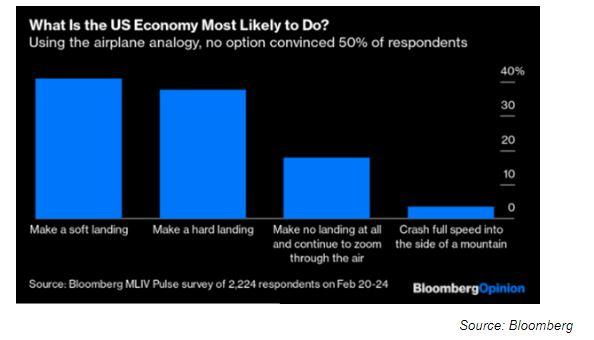

Recent Bloomberg Survey of investment professionals

This recent Bloomberg survey is quite a useful insight into where the thinking of professional investors currently sits regarding the soft or hard landing conundrum. It’s a split vote right now, with a fractional tilt to a soft landing, which most likely moves around a hair with every significant economic news release.

That nearly 40% of investment professionals polled are picking a hard landing for the US economy is telling you that it is likely that the US share market has a hard landing already partially priced in. It’s hard to know with any certainty how much, but it would leave one expecting share markets to go somewhat better if over the course of 2023 a soft landing becomes a consensus view.

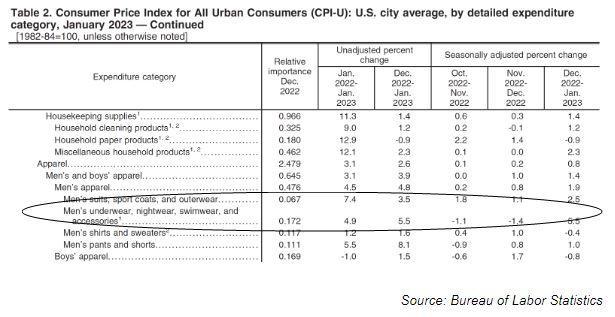

An extract from the latest Bureau of Labor Statistics CPI report

A little data point that bodes well for a soft landing is the price of men’s underwear, which is holding up in January 2023. In fact, with a rise of 5.5% it was the third strongest of over 300 CPI subcategories. Alan Greenspan, the long serving Chair of the US Federal Reserve, had a theory that when US households were starting to feel the pinch, the first discretionary spend to stop was on men’s underwear. His argument was that no one sees men’s underwear, unless it’s in the locker room and even then, would anyone comment on a tired looking pair of boxers. Unless you’re Dan Carter no one really gets to see the state of your Jockey’s.

So, this current strength in the price of men’s underwear is a potential read-through that US households are not currently dropping into crisis. That might change as we progress through 2023, so keep a close eye on the price of men’s underwear and other consumer discretionary items. If prices can keep bearing up it could be a confirmation that we will see a soft landing, which would be a real positive for share markets in the US and beyond.

The timing of how this could play out is another interesting facet of how share markets behave. In previous cycles the share market has managed to look ahead and pick the turning point in the economy about 6 months ahead of time. Applying that to this current situation, we are likely to have a decent steer on whether we have managed to have a soft landing late this year or very early next year. That would correlate to a potential turning point in the market around the middle of this year. If it’s a hard landing, then all bets are off, we will have to wait a while longer for that inflection point as economic conditions will be doing it harder for longer.

Share article:

Other Insights

February 2024 - Recent studies show that passive investing now outweighs active investing

Read more >Stay updated with Castle Point Funds.

Investments

Resources

Company

Castle Point Funds

Generator Britomart Place

Level 10, 11 Britomart Place

Britomart, Auckland 1010

PO Box 105889

Auckland 1143, New Zealand

E info@castlepointfunds.com

2024 Castle Point Funds, Inc. All rights reserved.

Privacy Policy